Startup School was such an eye-opener for PlebLab.

We weren’t just running a program; we were basically reinventing the wheel in public and trying to build a first-draft framework that actually works for early-stage Bitcoin companies. We’ll share more of that framework later this month.

One of the things I promised during Startup School was the infamous “investor update.” So I figured: instead of just talking about it, let’s ship the official PlebLab Investor Update format for our startups and walk through the logic behind it.

If you’re a brand-new Bitcoin builder, some of this might feel like overkill.

That’s normal. But here’s the reality: Early-stage investors, angels, and yes, PlebLab want you to win.

To help you win, we need to know what’s actually happening.

Metrics that don’t feel like corporate cosplay

When you’re just getting going, “metrics” can feel like corporate cosplay.

You have ten users, a half-broken Lightning flow, and some rando on X is telling you to “add Nostr integration and check your dm's while you’re at it.”

Breathe. Building on Bitcoin is Hard and Takes Time.

At the early stage, metrics are not about building a fancy dashboard.

They’re about answering three simple questions:

- Is the thing growing, even a little, every week?

- Is sats flow starting to look like a system, not a one-off tip?

- Most importantly is this a product that people actually love?

Everything else is just different camera angles on those three questions.

This post is a guide for PlebLab Startup School teams past and future:

- the few numbers that actually matter

- how to think about “benchmarks” without LARPing

- and most importantly how to wire all of this into a Bitcoin / Lightning reality candidly

At the end, I will point you to a Markdown file with the actual PlebLab Investor Update template you can remix and or copy to ship every month to us.

Keep in mind that a lot of the “big boy” thinking behind this came from books we covered in Startup School, like The Mom Test by Rob Fitzpatrick. Talk to customers like a human, then back it up with a few honest numbers.

1. Metrics as proof of work

Bitcoin founders: early on, you’re not proving you can be a unicorn. You’re proving very basic things, in this order:

- People have a real problem that you’re actually solving.

- They stick around, and hopefully tell their friends.

- They’re willing to pay, with the hardest money on earth (or fiat if they must).

During Startup School, the one primary metric we cared about depended on your stage of building your product:

- Still validating the idea? Okay, let’s track conversations/interviews per week.

- MVP live? Okay, let’s track weekly active users (WAU).

- Are people paying? Okay, let’s track monthly sats/fiat flow.

Pick the one that matches your stage, commit to it, and make consistent progress on that one number.

2. Follow the Flow: Sats and Fiat in Motion

If you’re building on Bitcoin, the real scoreboard is value moving through your product. I like to split it into three lines:

Flow in

Sats in

- Direct product revenue in sats

- Routing or liquidity fees

- Tips, donations, or pay-what-you-want

- Grants or sponsorships paid in bitcoin

Fiat in

- Direct product revenue in local currency

- Services, consulting, or integration work

- Grants or sponsorships paid in fiat

Flow out

Sats out

- Infra you pay in bitcoin: nodes, liquidity tools, services

- Contributors or contractors you pay in sats

- Experiments you run in sats: bounties, rewards, event costs

Fiat out

- Infra you pay in fiat: servers, SaaS, domain, tools

- Team, contractors, or vendors paid in fiat

- Operations: travel, legal, accounting, events

Flow metrics

- Total sats volume this month

- Number of Lightning transactions

- Average payment size in sats

- Number of paying users or merchants

- Total fiat revenue this month

- Rough monthly burn in both sats and fiat

You don’t need a CFO to start this. A simple monthly log already puts you ahead of most builders. We also have companies that came out of PlebLab that can help you track this properly:

- Zaprite can help you get paid and keep invoices sane.

- Clams, from our Top Builder program, can do accounting on a whole different level.

Later, this all ties into classic metrics like gross margin, CAC payback, and burn multiple, but for early-stage Bitcoin companies, it’s basically:

“Did more value flow through the system this month than last month, and do you know why?”

If you can answer that honestly every month, you’re in the game.

3. Engagement and retention: do people actually care?

Here’s the hard reality:

If people don’t keep using your product, nothing else matters.

For Startup School, we kept it really simple and asked to track:

- Daily or weekly active users (pick one and stick with it).

- How many of last month’s users came back this month.

- For transactional products, repeat payers and repeat transactions.

One thing to keep in mind:

Big consumer apps like Meta, Instagram, etc., see roughly 25% - 45% of users still active 6 months later and call that “good to great” retention.

You don’t need to be Meta, but you can steal the shape:

- If almost everyone disappears after week one, you have interest, not product-market fit.

- If around 30% to 40% of the people you onboard are still around a month later, you’re onto something.

- If you have a small group that basically lives in your product, protect them at all costs.

Those are your power users. Talk to them, build with them, give them the good stuff first.

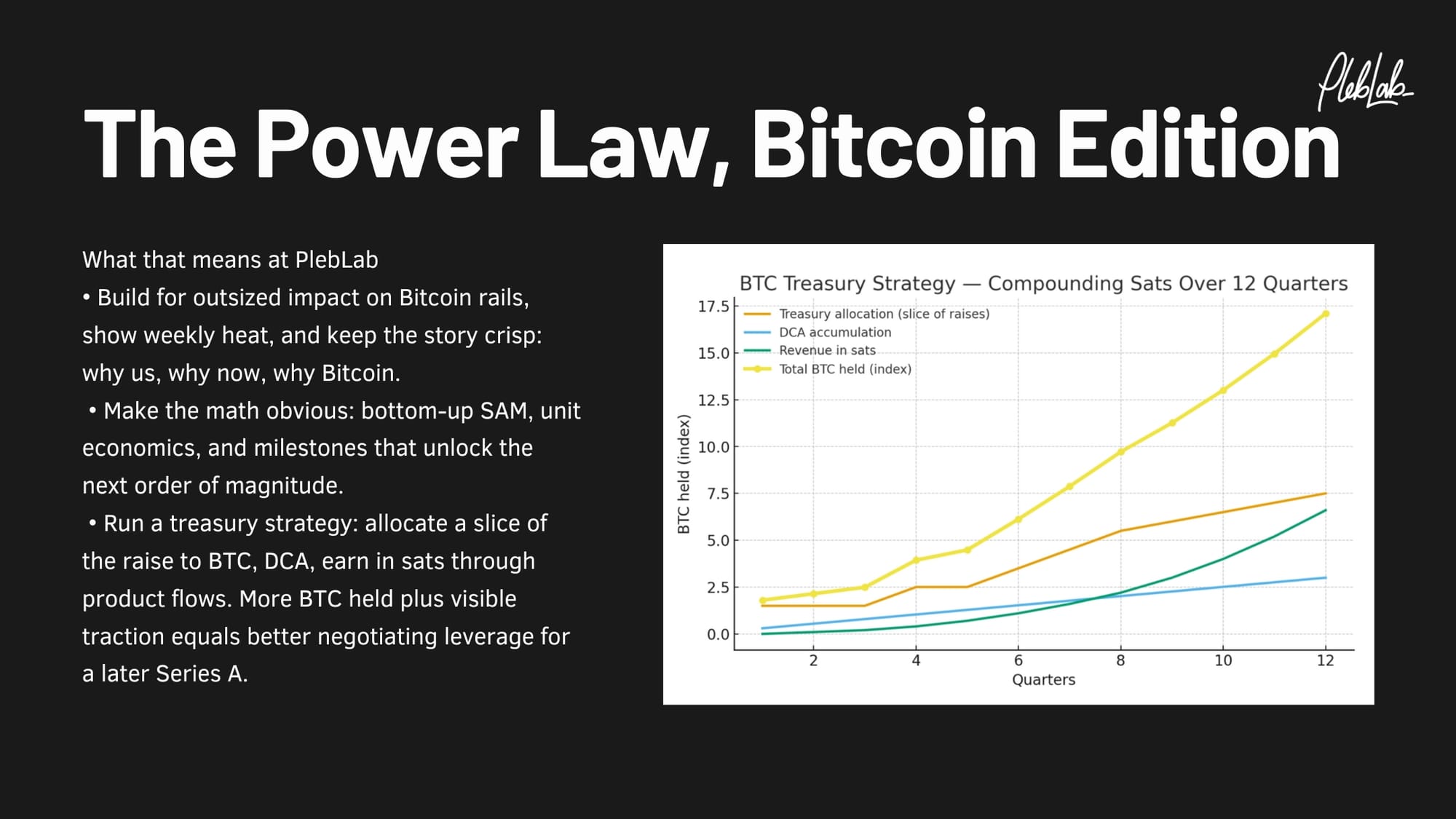

4. Growth: small weekly moves, big compounding

Paul Graham has a simple target that I love:

- 5% to 7% weekly growth is solid.

- 10% weekly growth is exceptional.

- 1% means you probably haven’t figured it out yet.

Here’s why it matters over a year:

- 2% weekly growth is about 2.8x.

- 5% weekly growth is about 12.6x.

- 10% weekly growth is about 142x.

That’s the magic of compounding. Tiny moves, every week, for long enough.

For Startup School, we ask to pick a weekly growth metric that lives close to the customer:

- Active users

- Sats volume

- Number of paying users

Then do three things:

- Set a realistic weekly growth target (3% to 5% is a good start).

- Every week, ask: “Did we grow this number? Why or why not?”

- Change the plan if the number isn’t moving.

This is how you turn “I’m grinding” into “the graph is actually going up and to the right.”

A couple of quick checks:

- If lots of people hit your page but almost nobody makes a first payment, you have a UX or onboarding problem. Remove friction.

- If people make one payment and disappear, you have a value problem. The thing they bought wasn’t worth coming back for.

Even better schedule a call with them to find out whaaattt happened???

5. Stay alive and watch your competition float by

When you’re building a Bitcoin company, staying alive is way more important than it feels in the early days.

Everyone is day dreaming NGU & future evals, but the founders who win are usually the ones who simply didn’t die.

Early-stage takeaway:

- If you’re burning aggressively and revenue isn’t moving, stop trying to scale and go back to product and retention.

- If revenue is growing faster than you’re burning, you’re in a good place, even if the absolute numbers are small.

- If you can keep burn low or close to zero while sats flow slowly ramps, you buy yourself an enormous amount of time to get it right. Hang in there!

The bear market has a way of washing out noise. If you can survive while others tap out, a lot of the “competition” just disappears on its own.

6. What “good” looks like for Startup School teams

Let’s talk about “good,” realistically, for early-stage Bitcoin builders coming out of PlebLab.

To me, “good” looks like this:

- A small group of users or merchants who keep coming back every week.

- One primary metric (users or sats/fiat) growing a few percent every week, and you actually understand why.

- Sats/Fiat flowing inside the product, not just tips from friends who like you.

- Burn under control, or better yet, no burn at all beyond tacos, rent, some coffee, spirits and infra costs.

Honestly, the biggest signal isn’t the number itself. It’s whether you can look an investor, advisor, or fellow pleb in the eye and say:

“Here’s the metric we care about. Here’s what it was last month and this month, and here’s what we’re going to try next.” If you can do that, while shipping, you’re already ahead.

That’s the whole spirit behind the PlebLab Investor Update:

One page that shows your proof of work in public, month after month, while the compounding quietly does its thing. Peep it below and feel free to remix it to make it your own!

PlebLab Startup School – Monthly Builder Update

Subject line

[Startup Name] – Monthly Builder Update – [Month Year]

Intro

Hey [Name],

Short one this month. Here’s where we are with product, sats/fiat flow, and runway for [Month].

TL;DR (3–5 bullets)

- Built / shipped: [largest product move this month, add links if applicable]

- Sats flow: [XX,XXX] sats in, [YY,YYY] sats out, [ZZ%] MoM growth

- Users / builders: [Number active users] ([change vs last month])

- Runway: [X] months at current spend

- Biggest focus next month: [one clear priority]

1. Product and Shipping

What we actually shipped and learned.

- Shipped: [feature 1] – impact: [why it matters]

- Shipped: [feature 2] – impact: [early signal / feedback]

- In progress: [feature or experiment] – target date: [date]

Link to demo, repo, post or video: [URL]

Optional quick hits:

- Time to ship: [days from idea to live]

- Bugs or outages worth noting: [short note if any]

2. Sats Flow (Revenue and Circularity)

Break down how sats are moving through the system. Keep it simple and speak candidly.

Sats In (top line)

- Direct product revenue: [XX,XXX sats]

- Routing / liquidity fees (if any): [X,XXX sats]

- Tips / donations / pay-what-you-want: [X,XXX sats]

- Grants / sponsorships received this month: [amount, if relevant]

Sats Out (core costs)

- Infra (servers, nodes, liquidity tools): [XX,XXX sats or fiat equivalent]

- Team / contributors: [XX,XXX]

- Community, events, or experiments: [XX,XXX]

Key Lightning / Bitcoin metrics

- Total payment volume (sent + received): [XX,XXX sats]

- Lightning transactions: [Number]

- Average payment size: [X sats]

- Channel events (if running nodes): opened [Number], closed [Number], capacity [X million sats]

Attach simple chart of sats flow or volume if you have it.

3. Fiat Flow (Revenue and Circularity)

Same as sats flow, just in fiat. Break down how fiat is moving through the system. Keep it simple and speak candidly.

Fiat In

- Direct product revenue: [$X,XXX]

- Services, consulting, or other: [$X,XXX]

- Grants / sponsorships / other: [$X,XXX]

Fiat Out

- Infra and tools: [$X,XXX]

- Team / contributors: [$X,XXX]

- Operations, events, or experiments: [$X,XXX]

Optional:

- FX or on/off ramp friction you are seeing: [short note]

4. Users and Engagement

Who is actually using this and how often.

- Active users this month: [Number] (vs [Number] last month)

- Power users (3+ sessions per week or similar): [Number]

- Retention: [e.g., X percent of users from last month came back]

- Segment that loves us most right now: [describe: plebs, merchants, devs, city, country, conference etc.]

Short story:

“[one or two sentences from a real user about why they like this]”

Optional:

- Primary weekly metric we are watching: [e.g., WAU, sats volume, paying users]

- Weekly growth on that metric: [X percent]

5. Experiments and Learnings

Show that you are running small tests and learning quickly.

- Test: [what you tried]

- Result: [what happened, with numbers if possible]

- Takeaway: [what you learned and what you will change]

Repeat for the two or three most important experiments.

Optional:

- Biggest surprise this month (good or bad): [short note]

6. Challenges / Where We Are Stuck

Be direct so mentors and investors know where to lean in.

- Product challenge: [what is not clicking yet]

- Sats flow challenge: [e.g., converting first timers to repeat payers]

- Go to market challenge: [e.g., who exactly to sell to first]

- Operational / legal / infra risks: [brief bullets]

If there is one thing keeping you up at night, write it here.

7. Asks for PlebLab, Mentors, and Investors

Specific, concrete requests.

- Intros: [type of people or companies you want intros to]

- Help: [e.g., pricing feedback, sales practice, Lightning setup review]

- Collaborators or hires: [role, time commitment, and what they would own]

Links or files to share:

- [Deck, demo, doc, or repo link]

8. Closing

Thanks again for all the support. If you want more detail on anything here, especially sats flow or product decisions, happy to jam on a quick call or go deeper on the numbers.

[Founder Name]

[Startup Name]

Ship, learn, repeat.

Interested in the next round of PlebLab Startup School? Jump on the newsletter so you’re first to know when applications open.

If you need help now, grab an Online Builder Pass and get your project in front of people who have been in the trenches. PlebLab’s mentors and network can help you work through roadblocks, sharpen the idea, and move faster toward real sats flow and real customers.

If you’ve got something specific you want to jam on, you can also schedule a one off call for a focused project or startup consultation.